Without question inheritance tax is the most controversial tax in the UK. To some it is a leveller in society, to others it is a tax upon tax already paid. Whatever your thoughts on the tax, if you have acquired a significant amount of wealth, you need an estate plan to ensure the majority of your wealth does not disappear to the HM Treasury.

Inheritance Tax Considerations

Unlike many forms of taxation which is simply about number crunching, inheritance tax throws up its fair share of questions, some of which may conjure emotional responses. Consider:

- Do you know how much money you’ll need to live the rest of your life in comfort?

- How do you pay for long-term care should you need it?

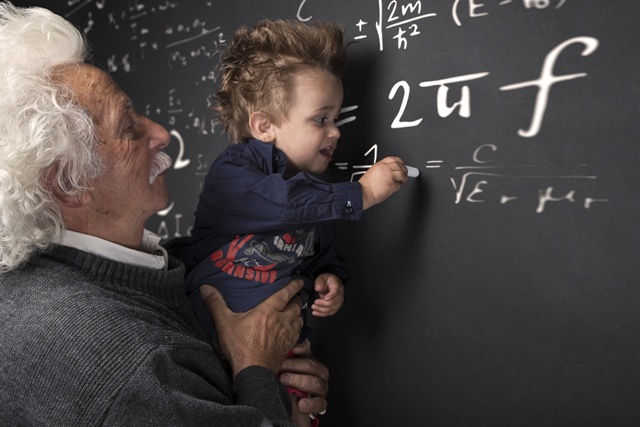

- Do you like the idea of giving your grandchildren and children money?

- Do you like the idea of paying rent to stay in your house?

First Steps to Successful Estate Planning

To get to grips with inheritance tax it is prudent to make a long-term financial plan. I am an award winning financial planner and can work with you to develop a comprehensive plan. Without this plan, making important decisions about your future will be impossible.

To this we’ll use cash-flow modelling to establish how much money you’ll need to live how you want to in the future. This will include aspects such as downsizing your house and other expected inflows of cash. This will underpin planning and give us a long-term view for your financial wellbeing.

We need to talk about your Legacy

Once it is clear if you can live comfortably, we can talk about what you want to do with the rest of your estate. There are a number of options available and by answering questions outlined below; we can get a good idea on how you want to pass on your wealth to your family. Consider:

- Do you want to make gift payments to your children and grandchildren?

- Do you want to keep control over how they spend your money?

- Would you like to be able to access the money in an emergency?

- Would you rather spend the money on specific areas such as house deposits or university fees?

- Would you rather leave your estate to your family when you die rather than when they are alive?

In many respects the best option to avoid inheritance tax is to understand what is important to you in the first instance, and then together we can explore the option that give you the most peace of mind and respects your wishes.

To get the ball rolling, simply click here and complete the Call Back Service form. Together we can plan your estate.

Source: Tilney

For more information, please contact Michele Carby at Holborn Asset Management on +971 50 618 6463 and on e-mail at [email protected]