All mothers worry it’s hardwired into our very being.

My work heightens my worries. It brings me into close contact with tragedy affecting other families several times a year – something that’s inevitable when you help people arrange life and medical insurances. Clients or members of their families fall seriously ill or pass away and need help making a claim. It’s always hard to deal with and brings home to me the fragility of our day-to-day ‘normal’ existence and how fate can turn lives upside down in an instance.

I know that on a personal level too. At 32, my brother was diagnosed with leukaemia. From my family’s experience, I am very aware of how serious illness changes lives.

As the primary income earner, I worry about how my family would cope if my income were to come to a juddering halt. My children depend me for financial support for their education but even more fundamentally for food, clothing and shelter.

As a mother, you worry about these things. Of course, men have similar concerns but I think the maternal instinct places a more acute emotional burden on a woman’s shoulders.

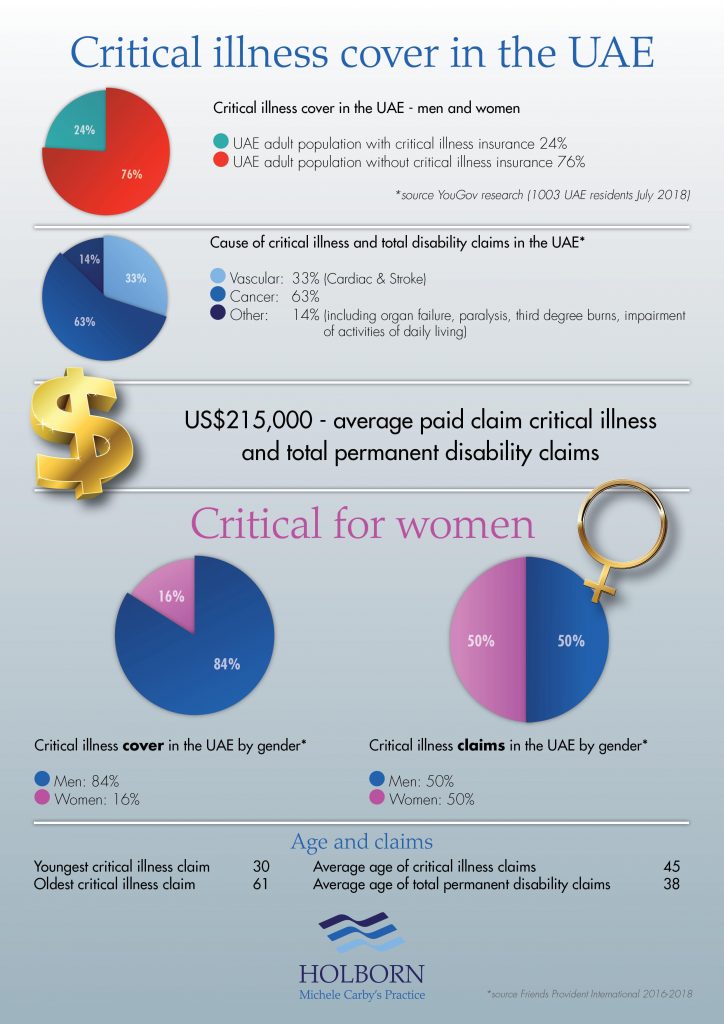

I know from speaking to my clients that other professional women feel the same. That’s why I want to underline to them the crucial importance of critical illness insurance. It provides a layer of protection that alleviates some of that burden of worry. Please look at the information below and you will see why.

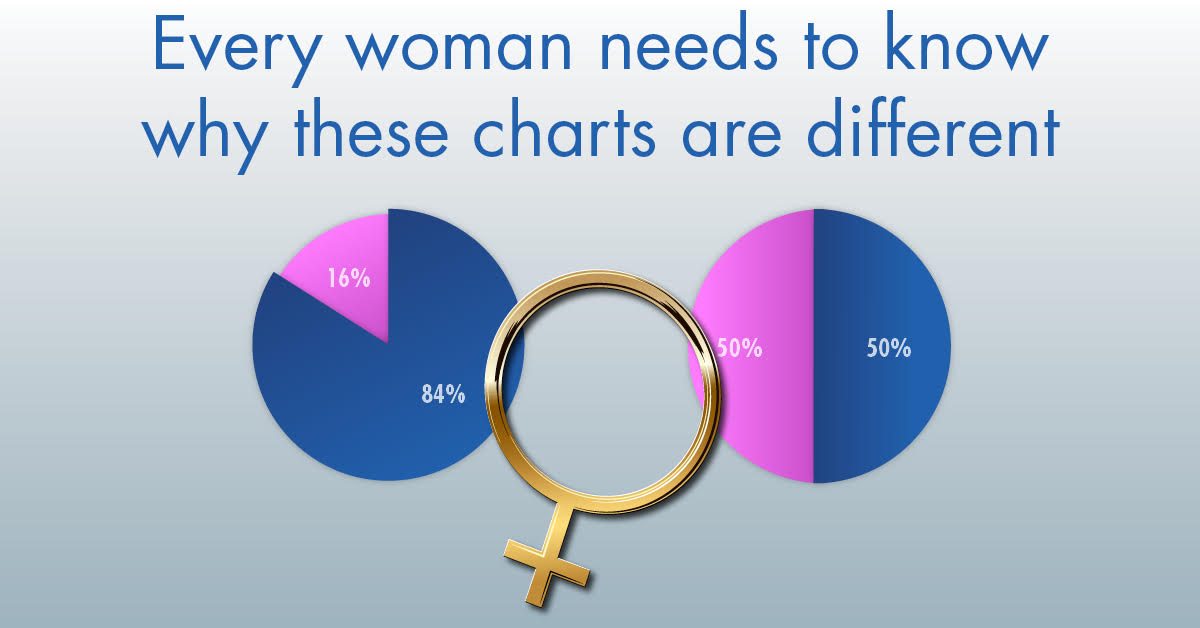

Critical for women

Critical illness insurance cover pays out a lump sum on diagnosis of a severe illness. The payouts are significant – the average paid claim is US$215,000.

There is no limitation on what you can spend the money on; it is yours in cash to use as you see fit.

But here’s the rub for women; they make a massively disproportionate number of claims. Far more than men. Just 16% of the policyholders of critical insurance in the UAE are women, but they make 50% of the claims. If nothing else these figures underline the vital importance that women get this cover, particularly if they are the family’s primary breadwinner.

I simply cannot recommend it high enough for professional women to get this insurance cover.

To illustrate this in real terms, I want to share the story of my friend and client, Nareena Mehra. A professional woman and mother, Nareena was diagnosed with breast cancer at the age of 36. Thankfully, her critical illness policy instantly paid out US$250,000, helping her get treatment, support her family and, after three years, make a full recovery. You can read Nareena’s story in more detail here, but take it as the perfect example of why you should have this insurance.

If you would like to discuss how critical illness cover could work for you, please get in touch with me. You can email me at [email protected] or if you prefer, call me direct on +971 50 618 6463.