If you plan to return to the UK after living overseas, the last thing you want is to find a significant, unexpected tax demand landing on your doorstep. To avoid this unwelcome fate, it is best to plan your return home well in advance and arrange your financial affairs to maximise the wealth gains you have accumulated while abroad.

We have designed this guide to highlight the most common issues affecting repatriating British citizens, as a starting point to help you identify the key issues. If any of these directly affect you and you need assistance navigating your return home, please get in touch.

UK expat tax residency

A clear understanding of your tax residency is the essential starting point for any British expat returning to the UK.

Your tax residency determines if you pay UK tax on:

- UK income and gains

- Overseas income and gains

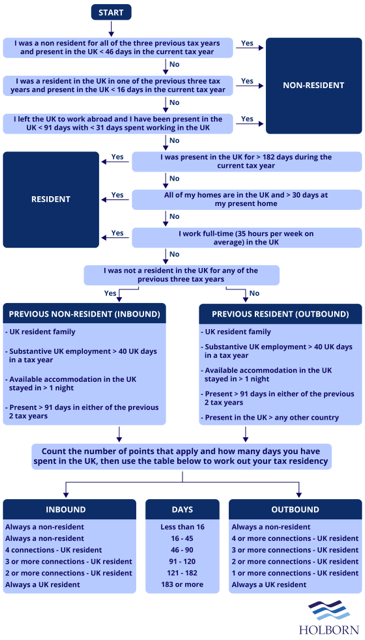

Residency is determined by the Statutory Residence Test (SRT). This is detailed on the UK government’s official website, but the diagram below is a visual guide to help you determine your status.

When you return home, you will once again be classified as a UK tax resident in the vast majority of cases.

Tax liabilities for returning UK expats

When you relocate to the UK, you should inform HMRC as soon as possible.

If you have been a resident overseas for less than a full tax year, you will remain classified as a UK taxpayer for the period.

If you have lived overseas for a more extended period, when you arrive back in the UK you’ll have a ‘temporary non-residence’ status if:

- You return to the UK within five years of moving abroad – if you left before 6th April 2013, this would be five complete tax years

- You were a UK resident in at least four of the seven previous tax years before you moved.

If either of the above rules applies to you, you would not normally be liable for UK tax on your employment income, but some income or gains as a non-resident may be taxable.

We strongly recommend you seek professional financial advice before you return, and as far in advance as possible, if you want to minimise your tax exposure. Michele is a world-leading expert in this field, and you can contact her directly here.

National Insurance Contributions for UK expats

Unless they have made prior provision, many UK expats fall behind on National Insurance contributions (NICs) while overseas.

You can check you NICs online and make up gaps through voluntary contributions.

Your overall level of contributions directly affect your eligibility for certain benefits, including the State Pension.

UK State Pension for expats

Entitlement to a UK State Pension is directly related to your National Insurance Contributions (NICS) level.

Currently, you need a minimum of 10 qualifying years of NICs to get any State Pension. To qualify for the maximum amount, you will need 35 years.

Before returning to the UK, it is essential that you check your record online, especially if you have been out of the country for an extended period.

Private Pensions & Investments

Any pension, savings plan or investments accumulated overseas may be liable for tax once you return to the UK. The amounts involved can be significant and influenced by a variety of factors pertinent to each individual.

We strongly advise consulting with a professional adviser in advance of your return to the UK.

Michele is a world-leading expert in this field, and you can contact her at [email protected] or book a direct call using the button below.